Client Information Management: Delivering Speed, Accuracy, and Value for Insurance

Download File:

Empower Insurance Teams with Faster, More Accurate Client Work

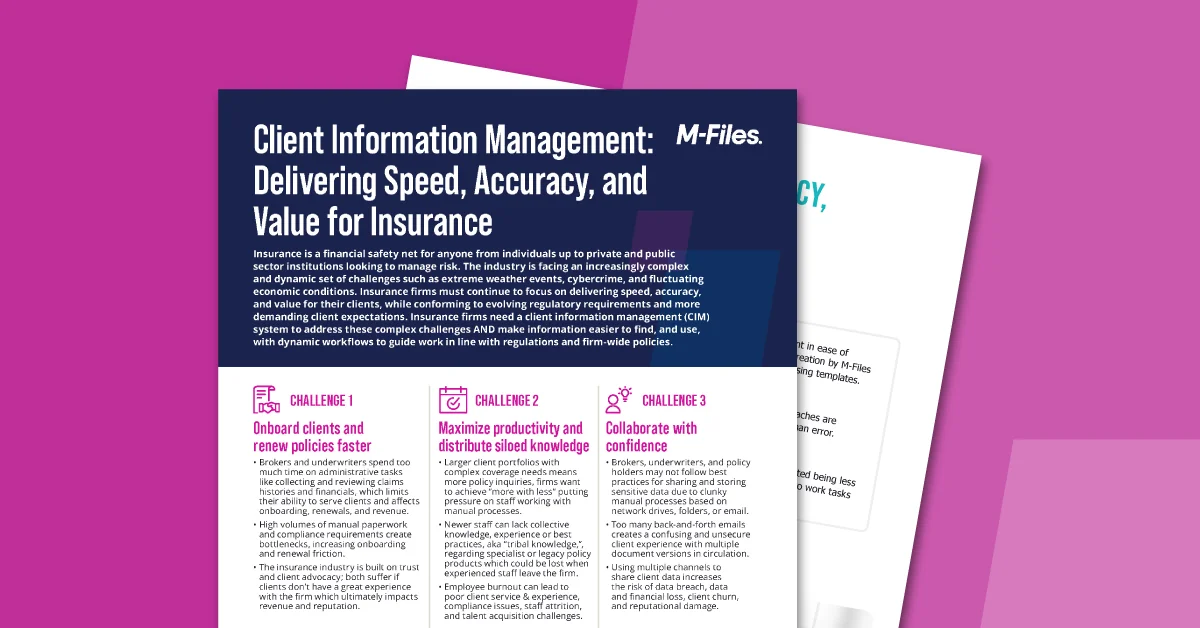

Insurance firms face rising pressure from extreme weather events, cybercrime, regulatory change, and increasing client expectations. As described in the solution brief, client information often sits in disconnected systems, email chains, or outdated folder structures, making onboarding and renewals slow and error prone. A modern Client Information Management solution centralizes client data, guides staff with workflows, and provides easy access to accurate information so brokers, underwriters, and claims teams can work with greater speed and consistency.

Strengthen Collaboration, Compliance, and Client Service with Intelligent Automation

When teams rely on manual processes, version confusion, and ad hoc file sharing, the result is slow service, higher risk, and a poor client experience. The brief shows how automation reduces administrative effort, improves proposal and underwriting quality, and ensures every stakeholder works from a single source of truth. Secure collaboration channels help firms exchange sensitive data confidently while automated audit trails and permissions protect client information and support regulatory compliance.

What’s Inside the eBook

Learn how Client Information Management helps insurance firms:

- Accelerate onboarding and renewals with automated workflows and templates

- Reduce manual work and eliminate version confusion with centralized information

- Capture and reuse institutional knowledge to support newer staff

- Improve underwriting and claims accuracy with structured, consistent processes

- Secure client data with controlled access and modernized information exchange

- Streamline audits with automated trails and rapid access to key documents

This eBook also highlights the impact of burnout, talent shortages, and regulatory pressure, and shows how automation helps firms do more with less.

Who Should Read This

- Commercial and specialty insurance brokers

- Underwriters and underwriting operations leaders

- Claims and client service teams

- Insurance operations and process improvement leaders

- IT, compliance, and information governance teams

Why Client Information Management Matters

Insurance runs on trust, accuracy, and speed. When information is scattered and processes rely on manual handoffs, firms risk delays, compliance gaps, and frustrated clients. The solution brief confirms that modern Client Information Management strengthens every stage of the client lifecycle by reducing administrative friction, enforcing secure data practices, and making knowledge easier to find and reuse. With better visibility, workflow guidance, and automated controls, firms deliver faster service, reduce risk, and create more value for clients.

Give Your Teams the Clarity and Speed Clients Expect

See how M-Files helps insurance firms streamline onboarding, improve accuracy, and protect sensitive client data with centralized information and intelligent automation. Start a free trial to explore how modern Client Information Management transforms client service and operational performance.